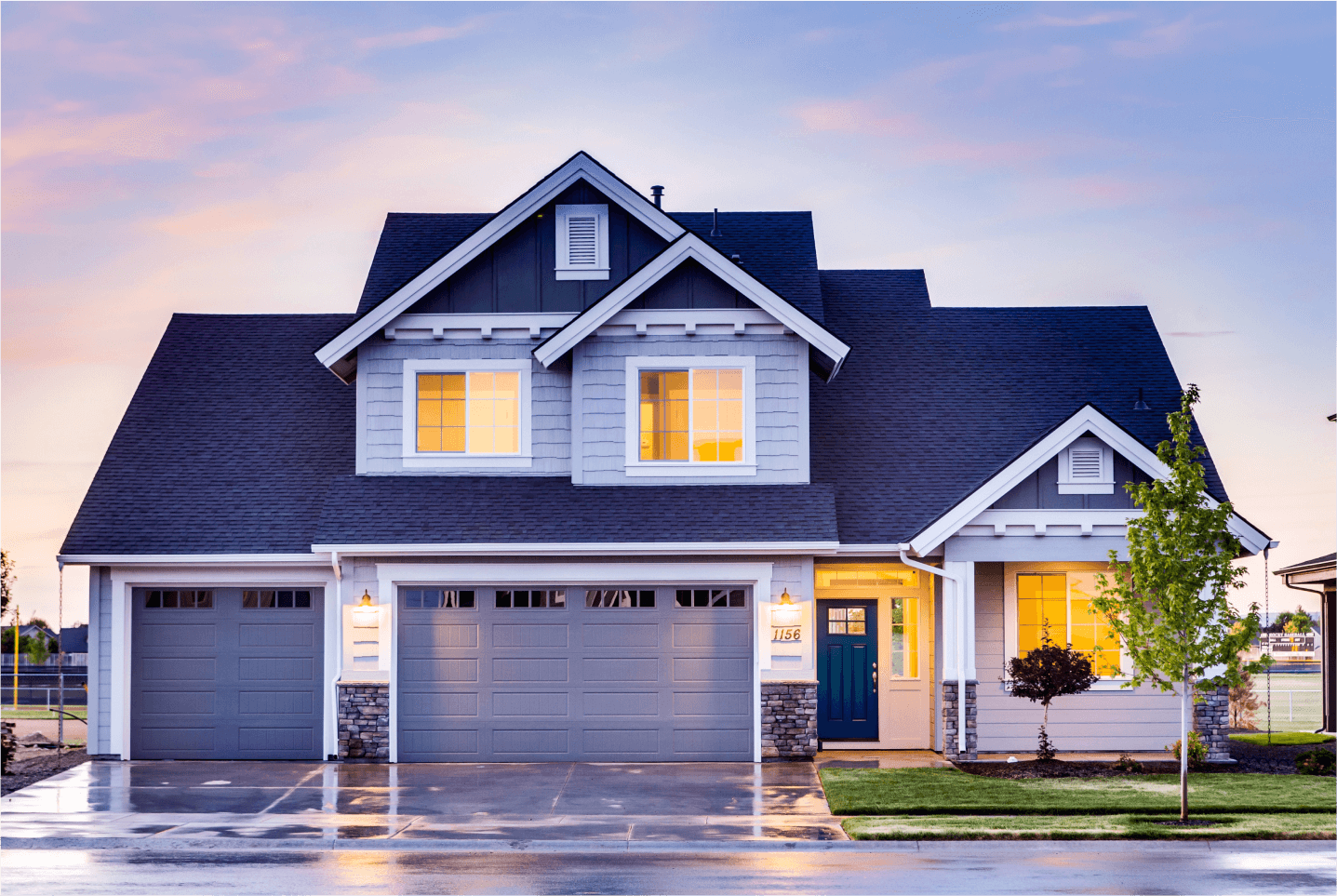

Are you ready to take the exciting leap into homeownership in Troy, Michigan? As a first-time buyer, the journey to owning your dream home may seem daunting, but fear not! Our team of knowledgeable mortgage loan officers is here to guide you every step of the way, providing you with the essential knowledge and empowering advice you need to make informed decisions.

Understanding the unique dynamics of the Troy, Michigan housing market is crucial for first-time buyers. Troy is a vibrant city known for its excellent schools, diverse community, and thriving business scene. As the largest city in Oakland County, Troy offers a range of housing options, from cozy starter homes to spacious family residences. Navigating the real estate landscape in Troy requires a keen understanding of the local market trends and opportunities.

Empowering yourself with knowledge is key to making confident decisions as a first-time buyer. To kick-start your home buying journey, here are some essential tips and insights to consider:

1. Assess Your Financial Readiness: Before diving into the home buying process, take a close look at your financial situation. Determine your budget, including your down payment, closing costs, and monthly mortgage payments. Our experienced loan officers can help you understand the financial requirements and explore mortgage options that align with your goals.

2. Understand the Mortgage Process: As a first-time buyer, the mortgage process may seem complex. Our team is dedicated to demystifying the mortgage journey for you, explaining each step in clear, accessible terms. We'll guide you through the pre-approval process, helping you understand the documentation required and the factors that impact your mortgage eligibility.

3. Explore First-Time Buyer Programs: In Troy, Michigan, there are various programs and initiatives designed to support first-time buyers. From down payment assistance programs to special loan options, our loan officers can provide valuable insights into the resources available to help you achieve your homeownership dreams.

4. Connect with Local Real Estate Professionals: Building a strong network of real estate professionals in Troy can greatly benefit first-time buyers. Our team works closely with reputable real estate agents, home inspectors, and appraisers in the Troy area. We can connect you with trusted professionals who understand the local market and can assist you in finding your ideal home.

5. Customize Your Mortgage Solution: Every first-time buyer has unique needs and preferences. Our loan officers are committed to tailoring mortgage solutions that align with your specific goals. Whether you're interested in fixed-rate mortgages, adjustable-rate mortgages, or other specialized loan products, we'll work with you to find the best fit for your financial situation.

As you embark on your journey as a first-time buyer in Troy, Michigan, we encourage you to reach out to our team to discuss your specific needs. Our friendly and knowledgeable loan officers are here to provide personalized guidance and support, empowering you to make informed decisions as you navigate the path to homeownership. Get in touch with us today to take the first step towards making your homeownership dreams a reality. Your future home awaits!

A conventional loan is a type of loan that is not insured by the government. Conventional loans offer more flexibility and fewer restrictions for borrowers, especially those borrowers with good credit and steady income.

FHA home loans are mortgages which are insured by the Federal Housing Administration (FHA), allowing borrowers to get low mortgage rates with a minimal down payment.

VA loans are mortgages guaranteed by the Department of Veteran Affairs. These loans offer military veterans exceptional benefits, including low interest rates and no ...

Calculate your mortgage payment, affordability & more

Find out which loan program is right for you

Get pre-approved in minutes with our quick & easy app